When you have suffered debilitating injuries and are pursuing a personal injury claim, one of the most popular ways of recovering compensation is through an insurance settlement. However, negotiating with the insurance company is not going to be easy. It is a profit-driven industry that prioritizes its financial interests above all else.

If you hope to protect yourself from being taken advantage of, it is crucial to have an experienced Atlanta personal injury attorney working for you. Negotiating your settlement with the insurance company can take some finesse. It is vital that you understand your rights and do not let your intimidation stop you from holding the insurance company accountable for their financial obligations.

How the Personal Injury Claims Process Works

Before you begin negotiating with the insurance company, it is important to understand how the personal injury claims process works. Generally, if someone else is responsible for causing your injuries, they can be held accountable and compelled to compensate you for your economic and non-economic damages.

But where do insurance negotiations come in? The answer is not always clear. If the individual or entity responsible for causing her injuries does not have insurance coverage, you may not need to file a claim with the insurance company, which means you will not need to negotiate; however, this is not often the case.

Most parties have some type of insurance coverage in place. For example, if you were involved in a car accident, the liable party would likely have auto insurance coverage. Alternatively, if you were involved in a work-related accident, your employer should have workers’ compensation protection coverage in place.

How Insurance Claims Work

Filing a claim with the insurance company is a great way to get specific types and amounts of damages covered. However, there are many restrictions to insurance settlement. Insurance only covers the types of coverage purchased.

This may seem obvious. But many injury victims are surprised to find they cannot seek compensation for non-economic damages through an insurance claim. Understanding what the insurance company is required to compensate you is critical as you head into negotiations.

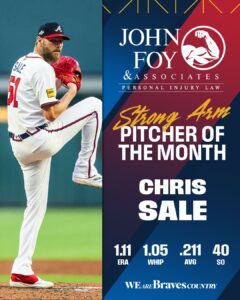

Get the strong arm

Tips for Negotiating with the Insurance Company

Now that you have a better understanding of how insurance works, here are some of our top tips for negotiating with the insurance company:

Understand the Value of Your Claim

Make sure you understand the value of your claim. Although you may need access to compensation as soon as possible, it is not unusual for insurance companies to make insultingly low settlement offers. They want to protect their profit loss at all costs and have no problem lowballing you even if they know your claim is worth more.

In fact, some insurance adjusters may be counting on the fact that you do not understand how much you are entitled to. For this reason, make sure you speak with your personal injury attorney about every way your life has been affected by your injuries. This way, you have a clear understanding of the value of your economic damages.

You should also go over the insurance company’s obligations. For example, if they are required to pay out up to $50,000 in bodily injury liability for your medical bills after a car accident, but if they were only offering you $15,000, do not get tricked into accepting a lesser amount that will leave you with remaining damages.

Do Not Forget to Address the Strong Points

As you attempt to negotiate with the insurance company, it is essential to emphasize the various ways your life has been affected by the accident or your subsequent injuries. For example, emphasizing permanent disabilities, exorbitant medical expenses, and evidence that the insured is responsible for causing your injuries can go a long way.

Although the insurance company may not be required to compensate you for non-economic damages, if you stress the significant impact the accident has had on your ability to live your life normally or that you are struggling to cope emotionally, it could influence the insurance company’s settlement offer.

Do Not Immediately Accept an Initial Settlement Offer

You should never accept an initial settlement offer unless you have reviewed it first with your personal injury attorney. If the insurance company makes you an offer that is less than the amount demanded in your personal injury demand letter, you might make a counteroffer that shows the insurance company you are willing to negotiate for a more reasonable settlement.

Get Your Settlement in Writing

Many insurance negotiations are verbal or over the phone. Before you take the insurance company’s offer seriously, make sure you get it in writing. This will also be considered valuable evidence that could be used to support your case if the insurance company attempts to retract its offer or delays the payout of your settlement.

Consider Working with a Personal Injury Attorney

If you hope to protect yourself from being taken advantage of by the insurance company, the best way to do so is to have your personal injury attorney handle the negotiation process for you. As soon as you have a lawyer working for you, the insurance company will see how seriously you are taking your case.

It is less likely that they will attempt to take advantage of you when an experienced legal advocate is fighting for your rights. If the insurance company handles your claim in bad faith, your personal injury attorney will be prepared to challenge their handling of your case and be ready to move forward with legal action should it become necessary.

Get Help from a Reputable Personal Injury Attorney Today

Dealing with the insurance company is one of the most challenging aspects of the personal injury claims process. The insurance company will take advantage of injury victims if it means furthering its own financial goals. When you have a dedicated personal injury lawyer at John Foy & Associates advocating for your rights, you do not need to worry about the insurance company’s manipulative tactics.

Our team will be by your side every step of the way showing the insurance company you are taking your claim seriously and will not back down until you get the settlement you deserve. Contact our office for a no-cost, risk-free consultation. You can reach us by phone or via our quick contact form to start working on your insurance claim and strategy as soon as today.

(404) 400-4000 or complete a Free Case Evaluation form